Event Recap: AI & FundTech by Next Gate Tech & LHoFT

Published on 26th of June 2025

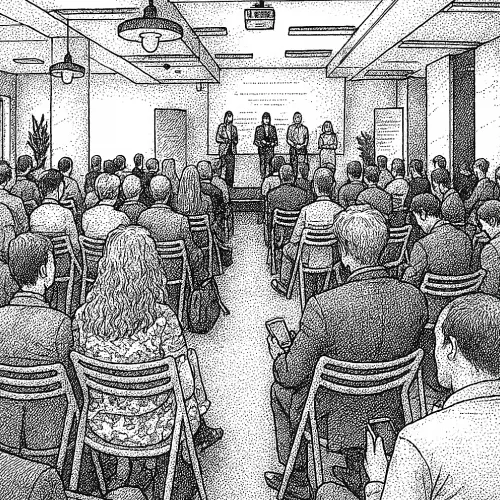

On 11 June 2025, over 100 professionals from Luxembourg’s fund and fintech sectors came together at the LHoFT for an in-depth evening of discussion, insight, and collaboration. The event, co-organised by Next Gate Tech and the Luxembourg House of Financial Technology (LHoFT), was sold out well in advance, reflecting the continued momentum Luxembourg is building as a hub for FundTech innovation.

Two Panels, One Theme: Practical Innovation for the Fund Industry

The first, a fireside chat titled "Innovation in Motion – AI & the Evolution of Technology in FundTech", examined how AI is being applied concretely in operational workflows and data infrastructure. The session was moderated by Judith Schleder from Silicon Luxembourg and featured Semin Ibisevic, Chief Technology Officer and Co-founder of Next Gate Tech, alongside Leonhard Kossmann, Chief Executive Officer of Fundvis. Together, they explored the role of AI in enhancing data management, workflow automation, and practical applications across the fund industry.

The second session, "Luxembourg as a Launchpad – Building the Future of FundTech", expanded the focus to include regulatory, investment, and institutional perspectives on how Luxembourg can continue to foster the next generation of FundTech development. The panel was moderated by Alex Panican, Deputy Chief Executive Officer of the LHoFT, and brought together Davide Martucci, Chief Executive Officer and Co-founder of Next Gate Tech; Serge Weyland, Chief Executive Officer of ALFI; Jerome Wittamer, Managing Partner at Expon Capital, Digital Tech Fund; Frédéric Becker, FinTech Advisor at the Ministry of the Economy; and Fateh Amroune, AI Factory Lead at Luxinnovation.

Together, the two sessions provided a comprehensive perspective on the practical adoption of AI and the broader dynamics shaping Luxembourg’s FundTech ecosystem.

Panel One: Innovation in Motion – AI & the Evolution of Technology in FundTech

The first discussion highlighted how artificial intelligence is already being deployed across data management, fund oversight, and workflow automation. The conversation began by grounding AI in real-world applications, with both panellists sharing how they approach data structuring and readiness as a prerequisite for meaningful AI outcomes.

Key insights included:

- The shift from experimental use cases to production-grade AI applications across middle- and back-office operations.

- The importance of keeping humans in the loop, particularly through “human-centric” AI design that enhances control, validation, and oversight.

- Practical examples of chat interfaces and agent-based tooling for regulatory reporting, oversight of delegated functions, and compliance with frameworks such as DORA.

The conversation then turned to user adoption. Building a tool is one challenge, driving engagement is another. Participants discussed the importance of interface simplicity, transparent results, and clear KPIs to foster user confidence.

In looking forward, the speakers identified several macro trends: increasing agentisation of AI platforms, improved data infrastructure, and the strategic use of Luxembourg as a base for scalable AI applications in the fund space. The overall message was clear, AI in FundTech is moving from concept to core utility.

Panel Two: Luxembourg as a Launchpad – Building the Future of FundTech

The second panel brought together voices from public and private institutions to discuss Luxembourg’s competitive positioning in the European and global FundTech arena.

From a regulatory association perspective, the discussion focused on the structural challenges facing the fund industry: operational complexity, regulatory pressure, and persistent margin compression. Technology was identified not just as a solution, but as an essential enabler for keeping Luxembourg at the forefront.

From an investor standpoint, speakers emphasised the need to support scalable FundTech ventures and to accelerate cross-border competitiveness. The role of visionary policy frameworks and targeted public-private partnerships was also underlined.

From a government and institutional lens, attendees learned more about available support mechanisms for AI and FinTech projects. Notably, the Luxembourg AI Factory was presented as a dedicated environment to support experimentation and development of sector-specific use cases, including for FundTech and fund governance.

Finally, from the entrepreneur’s point of view, the importance of trust, clarity in procurement cycles, and stronger collaboration across the ecosystem were all key themes. There was a strong call to action for the industry to continue building shared standards and cross-functional support for FundTech innovation.

Summary and Outlook

The event concluded with informal discussions and networking, bringing together professionals from management companies, fund administrators, regulatory bodies, technology firms, and institutional investors. The level of participation of over 100 attendees reflected sustained interest in the practical implications of AI and FundTech for fund operations. Conversations throughout the evening indicated a shared recognition of the need for structured, technology enabled approaches to oversight, governance, and regulatory alignment.

Rather than forward looking speculation, the event centred on real use cases, operational challenges, and the current pace of adoption confirming that FundTech is no longer a peripheral topic, but a core consideration for the industry.