CSSF Circular 24/856: Why Compliance Is Now a Tech Conversation

Published on 28th of May 2025

More than 300 industry professionals. One big message.

At the recent joint ALFI and ABBL event, the spotlight was on Artificial Intelligence in Luxembourg's financial sector. The turnout spoke volumes. Over 300 participants gathered, confirming what many already sensed: AI is no longer a future trend, it's firmly embedded in the present operations of financial industry professionals.

Two years after the initial CSSF survey, the 2025 update brought concrete numbers to back this up. With a response rate of 86% from 461 institutions, it's clear that AI adoption is widespread. While it's not exactly shocking that AI is being embraced, the findings also showed something deeper. Institutions aren't just experimenting with AI. They're using it to streamline operations, manage massive volumes of data, and make faster, more confident decisions.

At the same time, with CSSF Circular 24/856, the Luxembourg regulator is reinforcing its expectations for fund industry players to be technologically equipped. While the Circular is not about regulating AI, it does reflect a strategic shift: increased regulatory pressure on financial institutions to implement reliable systems, establish strong governance frameworks, and ensure transparency across the fund value chain. This isn't just a policy update, it's a pathway for how operational errors and breaches must be identified, addressed, and reported. And meeting those expectations simply isn't feasible without the support of technology.

Let's take a closer look.

What's the Circular Actually About?

Effective as of January 1, 2025, Circular 24/856 replaces the long-standing Circular 02/77. For over two decades, the industry worked with a framework that left too much open to interpretation. The FAQs filled in some blanks, but plenty of grey zones remained. Circular 24/856 changes that. It provides the clarity the fund industry needs. Here's what it introduces.

-

A wider scope: The new Circular doesn't just apply to UCITS and Part II funds. It now covers SIFs, SICARs, MMFs, ELTIFs, EuVECAs, and EuSEFs. Whether these are regulated or structured as RAIFs, they are included.

-

Clear responsibility: Previously, terms like "promoter" left room for debate. Now, responsibility is assigned directly to UCI dirigeants, fund managers, and everyone involved in managing and controlling the fund. If there's an error, it's clear who is accountable.

-

Specifics on NAV errors and breaches: Sections 4 and 5 outline exactly how to detect, treat, process, and report NAV errors and compliance breaches. There's no longer any need to rely on assumptions or industry practices. It also introduces new thresholds for what constitutes a material error.

-

Zero tolerance categories: Section 6 outlines specific categories of operational errors that cannot be ignored, regardless of size and impact. Swing pricing mistakes, undue costs, misapplied cut-off rules, and incorrect investments allocations now fall under a no-threshold rule.

-

Investor compensation and audit: Compensation guidelines are clearly laid out, with a direct obligation for beneficiaries to receive what they're owed. Auditors also have a more defined role in reporting and oversight.

In essence, this Circular builds a tighter, more transparent regulatory framework that better reflects today's operational realities.

Why This Demands More Than Just Compliance

While many fund administrators rely on established tech platforms, that alone won't cut it anymore. The CSSF expects a robust control framework, no matter who performs the function. Outsourcing doesn't shift responsibility. So, what does a "robust" framework really mean? At minimum, it should:

- Monitor NAV calculations and compliance in near real time

- Detect anomalies before they escalate

- Keep a detailed record of decisions, escalations, and resolutions

- Enable clear communication among stakeholders

And importantly, it has to scale. The Circular applies across an expanded set of fund structures, so systems need to be flexible enough to adapt.

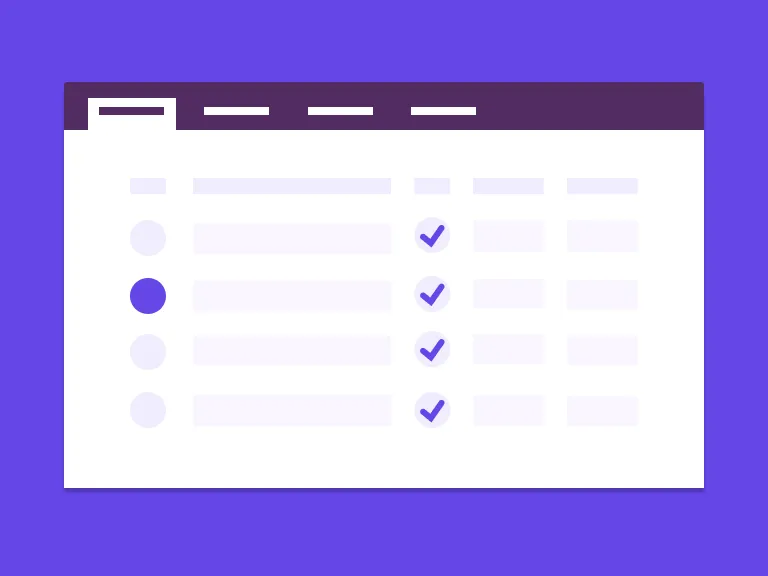

What Next Gate Tech Brings to the Table

At Next Gate Tech, we've built our NAV Oversight solution to meet exactly these kinds of requirements. Our technology blends deep industry experience with intelligent automation, helping clients stay in control without being overwhelmed. Our platform rests on three pillars:

-

Data Management: We automate the ingestion, cleaning, and structuring of fund data from multiple sources. It's streamlined and consistent, making oversight activities significantly easier to manage.

-

Analytics: Our platform runs thousands of checks each day using advanced statistical and machine learning models. These cover portfolio behaviour, valuation accuracy, share class dynamics, fee modeling, and more. We don't just alert you to issues, we help identify likely root causes and suggest paths forward.

-

Workflow: Our user interface brings it all together. With AI-powered summaries and investigative assistance, we cut down the time needed to get from issue to resolution. Everything is documented, prioritised, and aligned with oversight responsibilities.

The result? Faster decisions, fewer surprises, and stronger compliance; all from a single, centralised platform.

Looking Ahead

Circular 24/856 is more than just a regulatory update. It's a call to raise the bar. The CSSF is saying, clearly and directly, that oversight has to be both effective and proactive. Errors might happen. What matters is how quickly and transparently you identify, address, and document them.

For firms still relying on fragmented processes or legacy systems, that's going to be a challenge. But it's also an opportunity.

At Next Gate Tech, we believe fund oversight shouldn't be a reactive exercise. It should be smart, strategic, and seamlessly integrated into daily operations. Our technology helps clients shift from patchwork control to confident execution.

If your operations are affected by the new Circular — and chances are, they are — we're ready to help.

Let's Continue the Conversation

To explore these insights and more, Next Gate Tech is hosting a panel event: "NAV Oversight Under CSSF Circular 24/856: Six Months Later – How Is It Being Applied in Practice and Is Technology Really a Must-Have?" The session will feature expert insights from asset managers, consultants, and oversight professionals who have been working hands-on with the circular's implementation.

👉 Register now – Seats are limited