A New Era in ESG Oversight

Clarity AI and Next Gate Tech Integration for SFDR Reporting

Published on 7th of May 2024

The Sustainable Finance Disclosure Regulation (SFDR) mandates asset managers to report on the sustainability impacts of their investments, focusing on Principal Adverse Impacts (PAIs).

June 2024 marks the deadline for the second year reporting cycle of PAIs under SFDR. In this context, we highlight three broad trends that financial market participants could consider as the deadline approaches:

1. As this is already the second reporting period, scrutiny is set to increase:

In their September 2023 report on voluntary reporting of PAI in SFDR, the ESAs (European Supervisory Authorities) hinted that supervision and enforcement regarding PAI reporting was set to increase over the course of the coming years.

2. ESAs have made strong statements about the use of the “500 employee exemption”:

In the same report, the ESAs also noted that many market participants had misinterpreted the 500 employee threshold for reporting. They confirmed that “...FMPs do not consider any adverse impacts of investment decisions on sustainability factors, it is a good practice to include in the statement clear reasons for why they do not do so, and information as to whether and when they intend to consider such adverse impacts.” In other words, it is no longer enough to simply quote the 500 threshold as a reason for not reporting.

3. Data Dispersion:

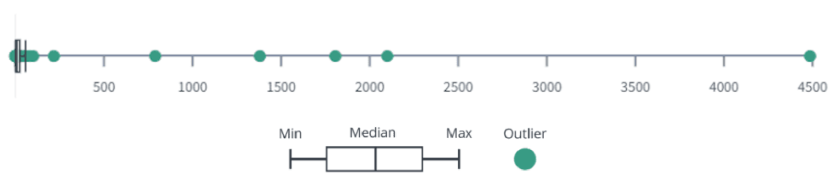

The second year also presents an opportunity for Financial Market Participants (FMPs) to reflect on their previous year reporting. In a review of a sample of 95 FMPs with Assets Under Management (AuM) above ~€20bn, Clarity AI observed dispersion of results per PAI. This may be due to various reasons, including varying investment and data collection strategies. For example, in the case of Mandatory PAI 9: Hazardous waste ratio, the SFDR RTS explicitly includes radioactive waste in its definition of hazardous waste, which is usually reported separately from the remaining hazardous waste. Without the sufficient tools and resources, clients can miss these metrics in the calculation thus resulting in the risk of regulatory scrutiny.

Figure 1: Data distribution for PAI 9 “Hazardous and radioactive waste” (tons/M€ invested). Note: Representation of mandatory PAI 8 data distribution, including data for 63 FMPs. Source: Clarity AI

#New SFDR Use Cases Enabled

Next Gate Tech has entered into a partnership with Clarity AI to enable asset managers to comply with these regulatory requirements more effectively and efficiently.

As a tech company, Clarity AI enables accuracy, alignment, and broader coverage for portfolio analysis, creation, and reporting:

-

Accuracy: Clarity AI’s SFDR PAI methodologies have been developed from first principles with tailored data collection campaigns and advanced machine learning models to account for the regulatory nuances, such as the inclusion of the appropriate water pollutants in PAI 8 and the correct hazardous waste components in PAI 9.

-

Alignment: With a team of experts, Clarity AI always strives to provide confidence in compliance - having already implemented the most recent changes from the ESA’s RTS review while continuously monitoring regulatory developments.

-

Broad Coverage: Clarity AI covers over 60,000 companies, providing a wide-ranging view of corporate practices and impacts, thus offering transparency and accountability.

With Next Gate Tech, their clients can focus on what's important and automate everything else, like oversight, data management, reconciliation and reporting for fund operations:

-

Fully Automated Data Management: Next Gate Tech's platform automates the transformation of complex ESG data landscapes, focusing on precision and efficiency. This ensures that asset managers have consistent and reliable data at their fingertips, empowering them to make informed decisions quickly.

-

Unique ESG Oversight and AI-Assisted Workflows: The integration of AI technologies enhances the platform’s ability to monitor and manage ESG data effectively. By predicting portfolio behaviour and identifying anomalies, the system offers comprehensive issue resolution. This proactive approach in managing data not only aids in regular compliance but also supports strategic decision-making under evolving market conditions.

-

NAV Oversight: Streamlines NAV calculation processes for enhanced accuracy and transparency, utilises advanced analytics for detecting discrepancies, and minimises operational risks in fund valuation.

Together, this partnership exemplifies a commitment to innovation and regulatory compliance, equipping clients with the necessary tools, such as a fully automated workflow that operates on a daily basis. It features built-in capabilities for straight reporting generation, covering all mandatory PAIs, effortless monitoring, and event-based management.

Interested parties are encouraged to contact us to learn more about how our products can transform your approach to fund oversight and regulatory compliance.